Credit Score Improvement: Taking You to the Next Level

Credit Score Improvement is a journey, and navigating the world of credit scores can often feel overwhelming. This is where Next Level Credit shines. With our specialized credit improvement services, we guide you through every intricate step. Our primary mission? To assist Americans like you in not only understanding your credit score but also in taking actionable steps to elevate it.

Empower your financial dreams by elevating your credit score. We’re here to guide every step of the way.,” – Next Level Credit

HOW WE CAN HELP YOU?

In today’s economic landscape, having a healthy credit score is crucial. Whether you’re aiming to buy a home, secure a loan, or start a business, your credit score plays a pivotal role. At Next Level Credit, we provide top-notch credit improvement services tailored for those seeking the best ways to improve credit.

- Personalized Consultation: Understand where you stand and the journey ahead.

- Actionable Steps: We provide you a roadmap to steadily improve your credit scores.

- Continuous Monitoring: Our team keeps a vigilant eye, ensuring positive changes reflect and negative discrepancies are challenged.

The Improve and Rebuild Credit Advantage

Improving your credit score isn’t just about rectifying past mistakes. It’s about forging a path towards a brighter financial future. Here’s how we help you rebuild and take your credit score to the next level

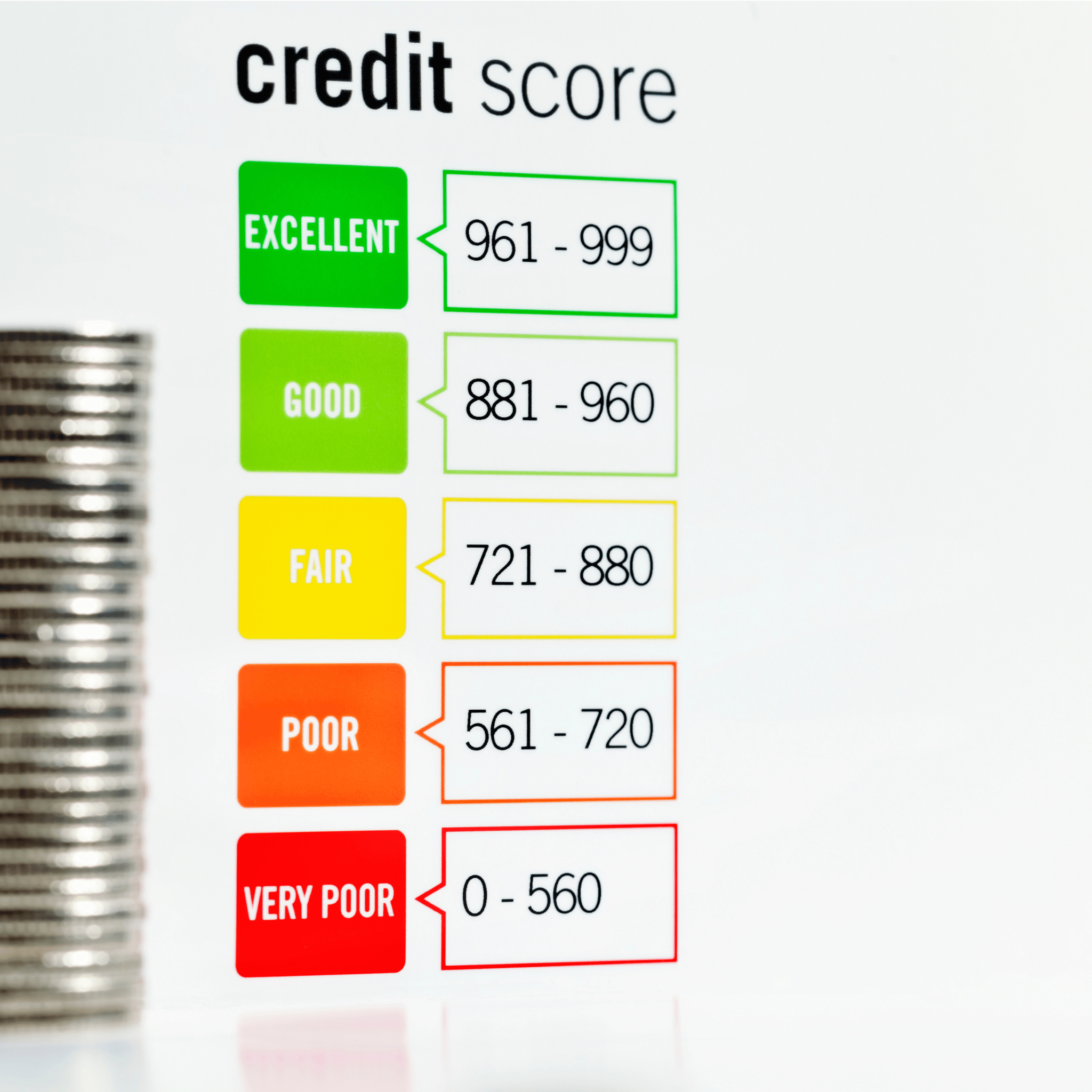

- Education: Equip yourself with knowledge. We shed light on how scores are calculated and the factors influencing them

- Dispute Resolution: Errors in credit reports can drag your score down. We assist in identifying and rectifying them promptly.

- Building Positive Habits: Through our guidance, you’ll discover best practices for improving your credit score and maintaining its health.

Why Choose Next Level Credit?

It’s not just about numbers. It’s about trust. With Next Level Credit, you’re choosing a partner committed to your financial growth. Our expert team, armed with the latest tools and industry insights, is dedicated to ensuring you reach your credit goals.

- Results-Driven Approach: Our track record speaks volumes. Countless Americans have found their way to financial freedom with our guidance

- Transparent Process: No hidden fees. No surprise clauses. We maintain transparency every step of the way.

Your credit score is the gateway to myriad financial opportunities. Don’t let past errors or lack of knowledge hinder your ambitions. With Next Level Credit, embark on a journey of credit score improvement and unlock a world of possibilities.

A credit score of 700 to 800 could take as little as a few months to several years.

One of the reasons why you should not pay a collection agency is because this doesn’t help improve your credit rating. The most likely scenario is that you pay the debt you owe, then you have to wait six years for the information to be removed from your credit report.

There is no guarantee that paying off debt will help the increase of your credit scores. However, you can see an improvement in your credit as soon as one or two months after you pay off your debt.

Government agencies frequently garnish federal income tax refunds since they are the most common federal payments. The TOP is the only way your tax refund can be garnished.

Only negative information disappears from your credit report after seven years. Open positive accounts will stay on your credit report indefinitely.

- Request your credit reports

- Review your credit reports

- Dispute all errors

- Lower your credit utilization

- Try to remove late payments

- Tackle outstanding bills

- Use multiple types of credit

- Get a credit builder loan

- Report bills to credit bureaus

- Use a finance tracking service

- Make consistent payments

- Keep your utilization low

Ready to elevate your credit score to the next level? Get in touch with us today!